10 Best Cash Advance Apps Like EarnIn

Find The Best Cash Advance Apps Like EarnIn

For many people, managing money between paychecks can be challenging. An unexpected bill, a car breakdown, or even a higher-than-usual utility payment can throw off the entire budget. That’s where cash advance apps like Earnin come in handy.

They give you early access to a portion of your paycheck, helping you cover urgent costs without turning to high-interest loans or credit cards.

Apps like EarnIn, such as Beem, MoneyLion, Chime, Dave, Brigit are leading the way by making financial flexibility more accessible. They allow you to withdraw a portion of your upcoming paycheck when you need it most, putting control back into your hands.

For users, this means less stress and more confidence in handling day-to-day financial challenges.

With the growing popularity of cash advance apps, there are now several options available—each with its own unique features, limits, and benefits.

If you’re curious about the best alternatives to EarnIn, the following list highlights some of the top choices you can explore.

Finance Market Statistics For Cash Advance Apps

The global demand for cash advance and paycheck advance apps has skyrocketed in the last few years.

Some statistics highlight the growing relevance of this sector:

- The Digital Payments market is projected to reach US$20.09 trillion in 2025.

- Between 2025 and 2030, it is expected to grow at a CAGR of 13.63%, hitting US$38.07 trillion by 2030.

- Mobile POS Payments will be the largest segment, with a forecasted transaction value of US$12.56 trillion in 2025.

- From a global perspective, China will lead the market, with transactions estimated at US$9.28 trillion in 2025.

- More than 40% of Americans admit to using paycheck advance or loan apps at least once.

- Millennials and Gen Z make up the majority of users, with 70% of app users under 40 years old.

These statistics clearly show why apps like EarnIn are growing popular and why businesses in this niche are investing heavily in technology and SEO to reach wider audiences.

Benefits of Having an SEO Agency for Cash Advance Apps Like EarnIn

In the highly competitive cash advance industry, simply having a great app is not enough. With dozens of apps offering similar services, the challenge is ensuring that potential users can find your app when they search for terms like “apps like Earnin” or “instant cash advance.”

This is where a professional SEO agency like Digiwalebabu becomes invaluable.

1. Improved Visibility

SEO agencies specialize in making your app visible to the people who are actively searching for solutions you provide. Through targeted keyword optimization, technical website improvements, and high-quality content creation, your app can appear higher in Google search results. This visibility drives organic traffic, bringing in users who are genuinely interested in your services, not just random visitors.

2. Enhanced Brand Credibility

Ranking at the top of search results signals trustworthiness to potential users. People tend to click on the first few results, assuming these apps are more reliable. An SEO agency ensures that your app maintains a strong presence in search engines, building credibility and increasing the likelihood that users will choose your app over competitors.

3. Cost-Effective User Acquisition

Paid advertising can be expensive and temporary, whereas SEO is a long-term investment. Once your app starts ranking organically, it continues to attract users without recurring ad costs. This makes SEO one of the most cost-effective ways to acquire high-quality, loyal users over time.

4. Targeted Audience Reach

Not all traffic converts into downloads. SEO agencies optimize your app for highly relevant keywords, ensuring that the audience reaching your app is genuinely interested in cash advance services. This targeted approach increases conversion rates, turning searchers into active users.

5. Strategic Content Development

Content is the backbone of modern SEO. Agencies help create blogs, FAQs, comparison guides, and landing pages that answer user queries, provide value, and naturally guide visitors toward downloading your app. This positions your brand as an authority in the cash advance space while also boosting search rankings.

Without a robust SEO strategy, even the best cash advance apps can remain invisible in a crowded market. Partnering with an experienced SEO agency ensures your app not only reaches the right audience but also grows sustainably, driving installs, engagement, and long-term user loyalty.

What’s the Cost to Do SEO for a Cash Advance App Like EarnIn?

Investing in SEO for a cash advance app is one of the smartest decisions a fintech company can make. In a competitive market where users are constantly searching for terms like “apps like Earnin” or “instant cash advance,” a strong SEO strategy can drive organic traffic, boost downloads, and build long-term credibility.

The cost of SEO varies depending on the scope, scale, and complexity of the project. Here’s a general breakdown:

1. Basic SEO – Ideal for Startups and New Apps

- Cost: $500 – $2,000 per month

- Focus Areas: Keyword research, on-page optimization, basic content creation, and technical SEO fixes.

- Who It’s For: New apps or startups that want to establish an initial presence in search engines without a massive budget.

2. Mid-Level SEO – For Growing Apps

- Cost: $2,000 – $5,000 per month

- Focus Areas: Advanced keyword targeting, competitor analysis, content strategy including blogs and landing pages, link-building, and performance tracking.

- Who It’s For: Apps that are gaining traction and need to expand their visibility and user acquisition through organic channels.

3. Enterprise SEO – For Well-Established Apps

- Cost: $5,000 – $10,000 per month

- Focus Areas: Comprehensive SEO covering all technical optimizations, high-volume content production, backlink strategies, CRO (conversion rate optimization), analytics tracking, and ongoing strategy refinement.

- Who It’s For: Large fintech brands with multiple product lines or apps looking to dominate the search results and sustain market leadership.

Factors That Affect SEO Costs

- Number of Keywords Targeted: More keywords require more content and optimization effort.

- Competitiveness of the Niche: Highly competitive fintech keywords are harder to rank for and require stronger SEO campaigns.

- Technical SEO Requirements: Site speed optimization, mobile-friendly design, schema markup, and other technical fixes can affect cost.

- Content Creation & Link-Building: Quality content, blog posts, and backlinks are critical for ranking and may require additional investment.

Why Investing in SEO is Essential

In the fintech space, organic visibility is not optional—it’s crucial. Paid ads may drive short-term downloads, but SEO ensures long-term user acquisition, higher trust, and sustainable growth.

Without proper investment, even the best cash advance apps risk being invisible to potential users actively searching online.

How SEO Investment Pays Off

- Organic Traffic Growth: Each dollar invested in SEO drives users actively searching for “apps like Earnin” or “instant cash advance”, giving better conversion potential than paid ads.

- Cost-Effective User Acquisition: Unlike paid ads, SEO continues to generate traffic and app downloads even after initial campaigns, reducing long-term marketing spend.

- Brand Credibility & Trust: High rankings signal authority and reliability, making users more likely to download your app.

- Competitive Advantage: Well-optimized apps outperform competitors in search, capturing market share and increasing lifetime user value.

- Sustainable Growth: SEO is a long-term investment that compounds over time, delivering measurable results month after month.

What Are Cash Advance Apps

Cash advance apps are digital platforms that allow users to borrow money against their future paycheck. Unlike traditional payday loans, they usually don’t charge high interest rates. Instead, they make money through tips, subscription fees, or premium features.

Here’s what makes them attractive to users:

- Instant Access to Money – Funds can be accessed instantly or within a day.

- Low or No Interest – Most apps charge no interest, relying on alternative revenue streams.

- Convenient & Transparent – Easy to use, with no hidden fees.

- Budgeting & Financial Tools – Some apps also provide budgeting tips, financial tracking, and savings features.

Cash advance apps are bridging the gap between traditional banks and modern financial needs, making them a vital part of personal finance.

What is EarnIn App?

The EarnIn app is a financial tool designed to give people more control over their paychecks by offering early access to the money they have already earned.

Instead of waiting until payday, users can withdraw a portion of their wages instantly, helping them handle urgent expenses like medical bills, groceries, or utility payments without turning to high-interest credit cards or payday loans.

At its core, Earnin works on a simple principle: you only access the money you’ve worked for, not borrowed funds. Once you connect your bank account and verify your employment, the app tracks your earnings based on your work hours.

When you need cash, you can withdraw a certain amount, which is then deducted from your paycheck on payday. This eliminates the cycle of debt that often comes with traditional loans.

One of Earnin’s unique features is its “tip-based” system. Unlike banks or payday lenders that charge fees or interest, Earnin lets users pay what they think is fair through voluntary tips.

This makes the service more affordable and flexible, particularly for individuals who are already stretched thin financially. The app also includes tools like Balance Shield, which alerts users if their account balance is running low, and Lightning Speed, which allows for faster cash transfers.

Earnin is especially helpful for people living paycheck to paycheck, where even small, unexpected expenses can cause financial stress.

By offering early access to earnings, the app provides a safety net without long approval processes or credit checks.

Ultimately, Earnin empowers users to bridge the gap between paydays in a way that is simple, transparent, and user-friendly.

Key Features of Earnin:

- Cash Out Instantly – Access wages before payday.

- Balance Shield – Alerts when your bank balance is low.

- Lightning Speed Transfers – Option for instant money transfers.

- No Credit Check – Makes it accessible for users with low credit scores.

While Earnin is excellent, it isn’t the only option. Let’s explore 10 earnin alternatives that might be better suited for different financial needs.

10 Best Apps Like Earnin

Apps like Earnin provide early access to earned wages, helping users cover expenses before payday. Popular earnin alternatives include Beem, Dave, Brigit, MoneyLion, Chime, PayActiv, Albert, and Branch. These apps not only offer cash advances but also come with features such as overdraft protection, budgeting tools, credit-building options, and financial tracking, making it easier for users to manage money and avoid costly fees.

| App Name | Max Cash Advance | Unique Features | iOS Rating | Android Rating |

|---|---|---|---|---|

| Beem | upto $1000 | Combines cash advances with financial education | 4.7/5 | 4.5/5 |

| Dave | $500 | Side Hustle job-matching & credit-building | 4.8/5 | 4.6/5 |

| Gerald | Varies | Bill management + cash advances | 4.6/5 | 4.4/5 |

| Brigit | $250 | Overdraft prediction & financial alerts | 4.7/5 | 4.5/5 |

| Klover | $200 | Rewards system via surveys & ads | 4.5/5 | 4.3/5 |

| MoneyLion | $500 | All-in-one platform: investing, credit, banking | 4.7/5 | 4.5/5 |

| Varo | Eligible users | Digital bank + early direct deposit | 4.6/5 | 4.4/5 |

| FloatMe | $50 | Fast, interest-free small advances | 4.5/5 | 4.2/5 |

| Chime | $200 (SpotMe) | Fee-free banking + early pay | 4.8/5 | 4.6/5 |

| Cleo AI | $100 | AI-driven budgeting & interactive finance | 4.6/5 | 4.3/5 |

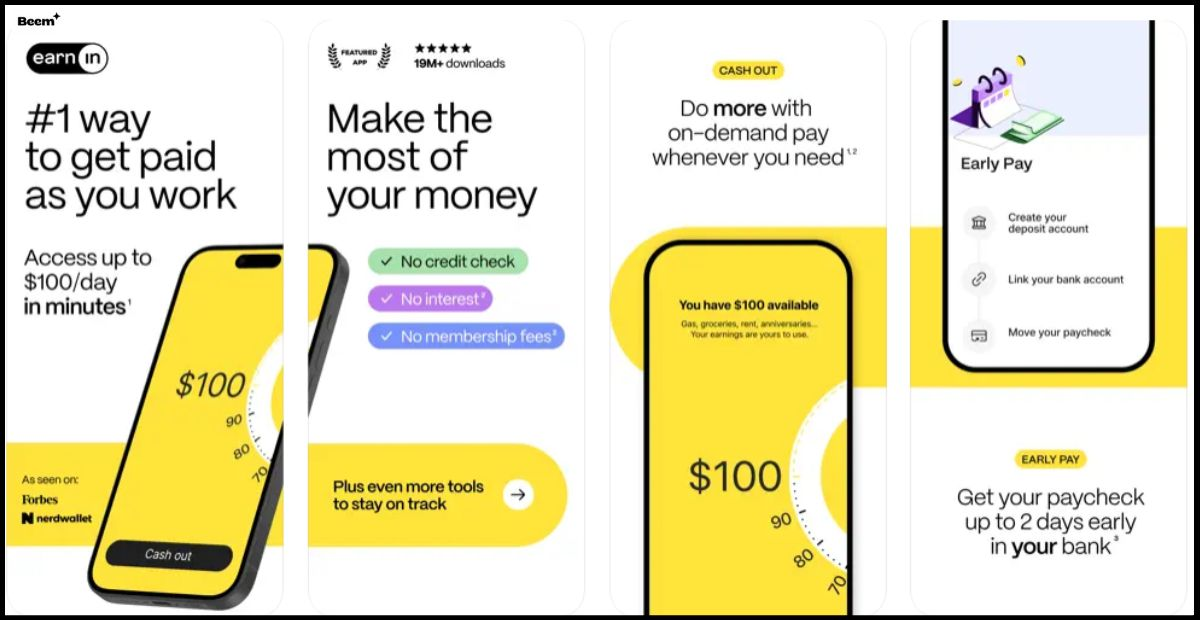

1. Beem

Beem is a modern financial app and one of the top apps like EarnIn, providing instant cash advances alongside money management tools. Unlike payday loans, Beem avoids interest and hidden fees, making it ideal for users living paycheck to paycheck. It combines financial wellness with instant access to earned wages.

The app aims to give people peace of mind by helping them cover daily expenses, emergencies, or unexpected bills.

Why Beem Stands Out:

Beem positions itself as more than just a cash advance provider. The app blends financial wellness with accessibility, making it not just a borrowing tool but also an educational resource.

With Beem, users can track expenses, identify spending patterns, and access cash advances instantly, all while avoiding the high interest and fees often associated with payday lenders.

Key Features:

- Instant cash advances up to a certain limit with no credit checks.

- Financial wellness tools, including budgeting and expense tracking.

- Transparent pricing structure with no mandatory fees.

- Automatic repayments on payday, ensuring convenience.

- Helps build better financial habits through insights and reminders.

Pros and Cons:

| Pros | Cons |

|---|---|

| Combines cash access with financial education | Advance amounts may be low for larger emergencies |

| Transparent and easy to use | Occasional processing delays |

| No credit checks required |

Reviews:

- On the App Store (iOS), Beem has earned positive feedback, often praised for its easy-to-use interface and the speed of cash transfers. Users appreciate how it helps them avoid overdraft fees and payday loan traps.

- On the Google Play Store, Beem is similarly well-received, with many reviewers noting its reliability and straightforward process. However, some users have mentioned they’d like to see higher cash advance limits as the app grows.

Overall, Beem stands out as a safe, transparent, and user-friendly alternative to EarnIn, especially for individuals seeking quick financial relief paired with money management tools.

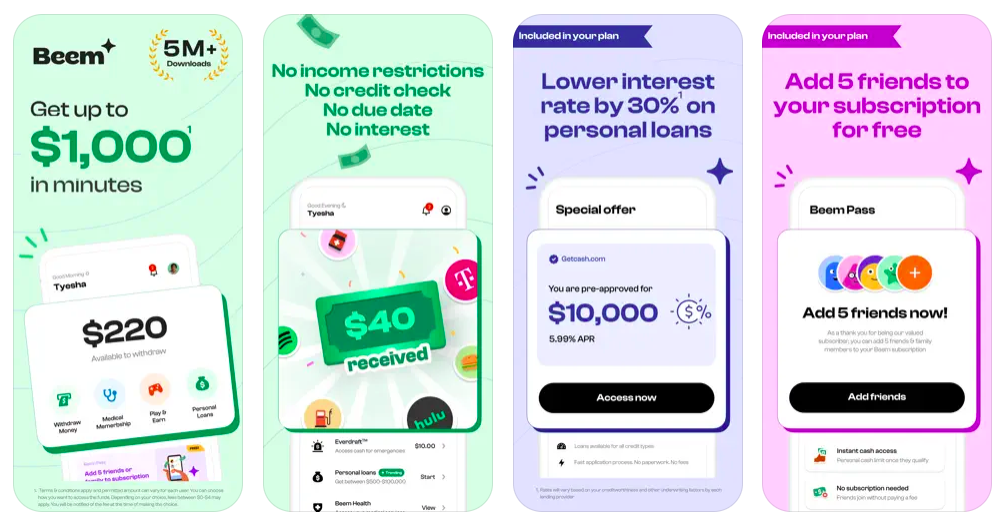

2. Dave

Dave is one of the most popular cash advance apps like EarnIn, designed to help users avoid overdraft fees and better manage their finances. With Dave, users can get small advances on their upcoming paycheck, making it easier to handle urgent expenses without relying on high-interest loans.

Key Features:

- Cash advances up to $500 with no interest.

- Budgeting tools to track expenses and predict upcoming bills.

- “Side Hustle” feature that connects users with job opportunities to boost income.

- Automatic repayment on payday, ensuring a seamless experience.

- Credit-building tools to improve financial health over time.

Pros and Cons:

| Pros | Cons |

|---|---|

| High advance limits | Customer support can be slow |

| Side Hustle income feature | Occasional processing delays |

| Credit-building opportunities | — |

Reviews:

- On the App Store (iOS), Dave has received strong ratings for its simplicity and reliability. Many users highlight how it helps them avoid overdraft charges and provides peace of mind before payday. Some reviews, however, suggest improvements to customer support.

- On the Google Play Store, Dave is also highly rated, with users praising its cash advance feature and the helpful budgeting tools. A few users note that while the app is easy to use, processing times could be faster in certain cases.

Best For: Dave is ideal for people looking for apps like EarnIn that combine paycheck advances with income-boosting opportunities.

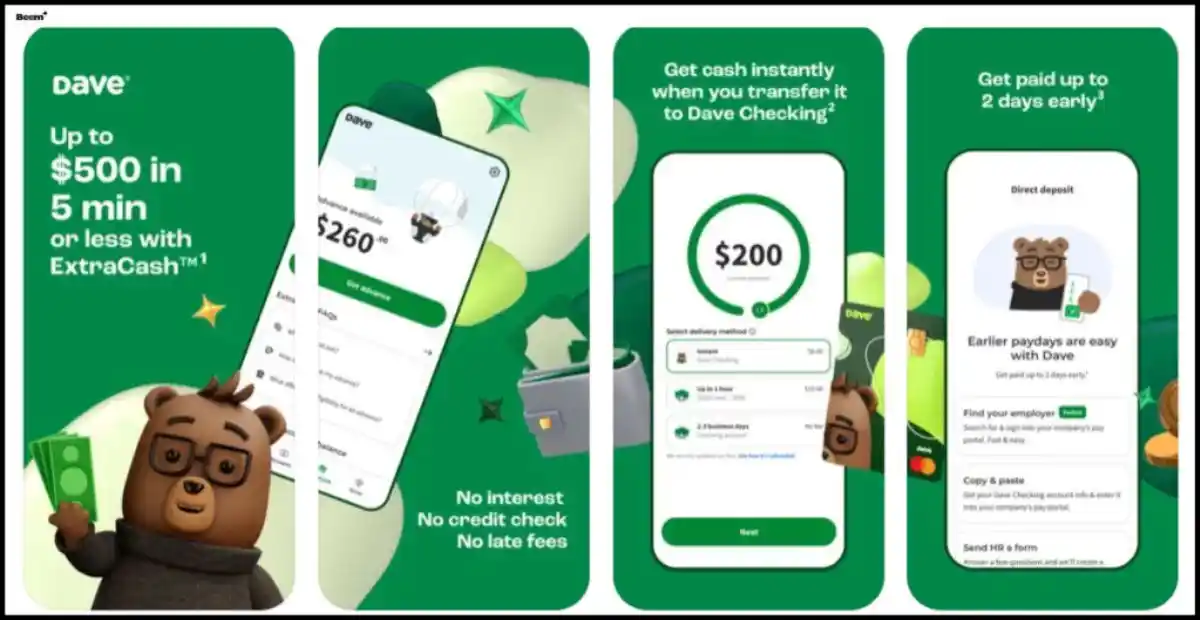

3. Gerald

Gerald is a practical option among apps like EarnIn, offering cash advances alongside bill management tools. It ensures users avoid late fees and helps manage multiple monthly payments in one place.

Why Gerald Stands Out: Unlike many EarnIn alternatives, Gerald focuses on bill tracking, making it perfect for users who need both cash access and payment management.

Key Features:

- Cash advances with no credit checks.

- Bill management and reminders.

- Secure bank integration.

- Early paycheck access.

- Financial dashboard for spending oversight.

Pros and Cons:

| Pros | Cons |

|---|---|

| Combines bill management with cash access | Advance amounts may be limited |

| Easy setup and secure | Repayment schedules can be rigid |

| Helps prevent late payment penalties |

User Reviews:

- iOS: Praised for bill-tracking and simplicity; some request higher cash limits.

- Android: Positive feedback for combined bill and cash management; repayment flexibility could improve.

Best For: Gerald is ideal for users searching for EarnIn alternatives that provide both short-term cash access and bill management tools.

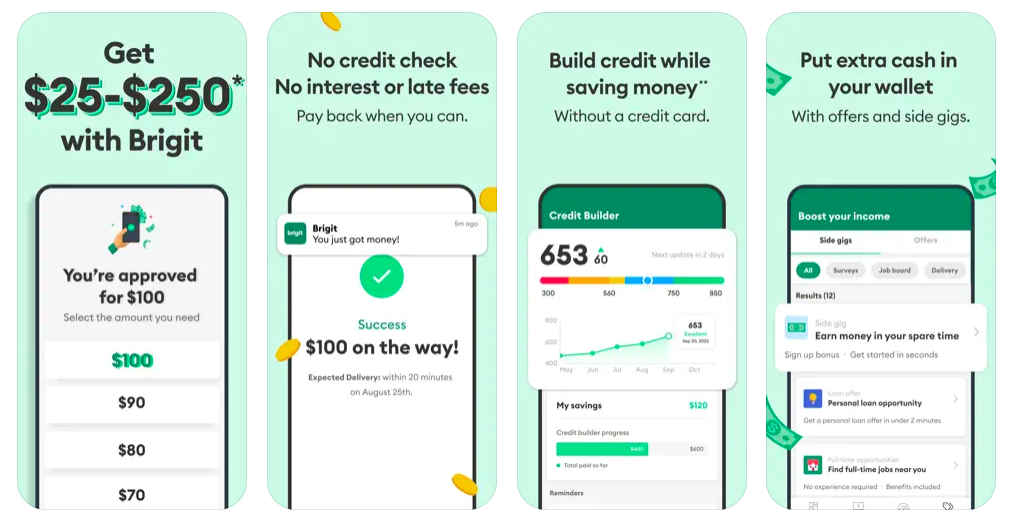

4. Brigit

Brigit is a financial wellness app and a top choice among apps like EarnIn, designed to prevent overdraft fees while offering small cash advances. It focuses on providing insights and financial tools that help users manage short-term expenses responsibly.

Why Brigit Stands Out: Unlike typical cash advance apps, Brigit proactively monitors spending and alerts users about potential low balances. This makes it a more thoughtful alternative among EarnIn alternatives, combining advances with predictive budgeting.

Key Features:

- Cash advances up to $250.

- Overdraft prediction alerts.

- Spending insights and budgeting guidance.

- Credit-building programs.

- Repayments automatically scheduled on payday.

Pros and Cons:

| Pros | Cons |

|---|---|

| Proactive overdraft alerts | Lower cash advance limits |

| Combines advances with budgeting insights | Eligibility requirements may be strict |

| Helps build credit over time |

User Reviews:

- iOS: Highly rated for its overdraft alerts and ease of use. Some users note that cash advance limits could be higher.

- Android: Praised for reliable budgeting tools and fast access to funds; a few reviews mention eligibility requirements can be strict.

Best For: Brigit is perfect for users seeking apps like EarnIn alternatives that not only provide cash advances but also help prevent overdrafts and encourage smarter financial habits.

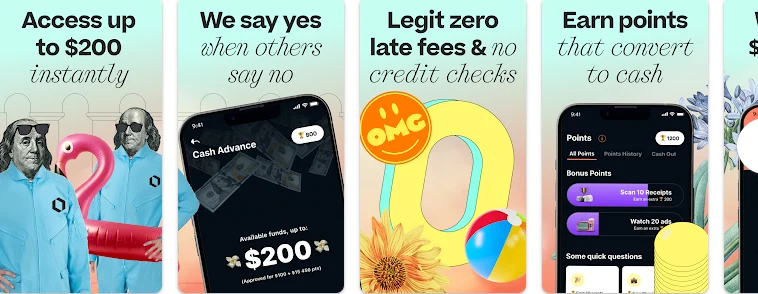

5. Klover

Klover is a unique app in the lineup of apps like EarnIn, offering small cash advances along with a rewards system. Users can earn extra benefits by watching ads, completing surveys, or engaging with sponsored content.

Why Klover Stands Out: Klover blends financial flexibility with gamification, making it stand out among EarnIn alternatives. It’s ideal for users who want access to small advances while also earning rewards and engaging with offers.

Key Features:

- Cash advances up to $200 with no credit checks.

- Reward system through surveys and ads.

- Spending insights and tips.

- Secure connection with bank accounts.

- Automatic repayment on payday.

Pros and Cons:

| Pros | Cons |

|---|---|

| Rewards-based system | Cash advance limits can vary |

| Easy to use and transparent | Some delays in transfers |

| No credit checks |

User Reviews:

- iOS: Users appreciate the transparency and reward-based features, though some mention slower transfers.

- Android: Praised for ease of use and reliability; advance amounts can vary based on usage history.

Best For: Klover is best for those exploring EarnIn alternatives that combine instant cash access with small rewards and interactive features.

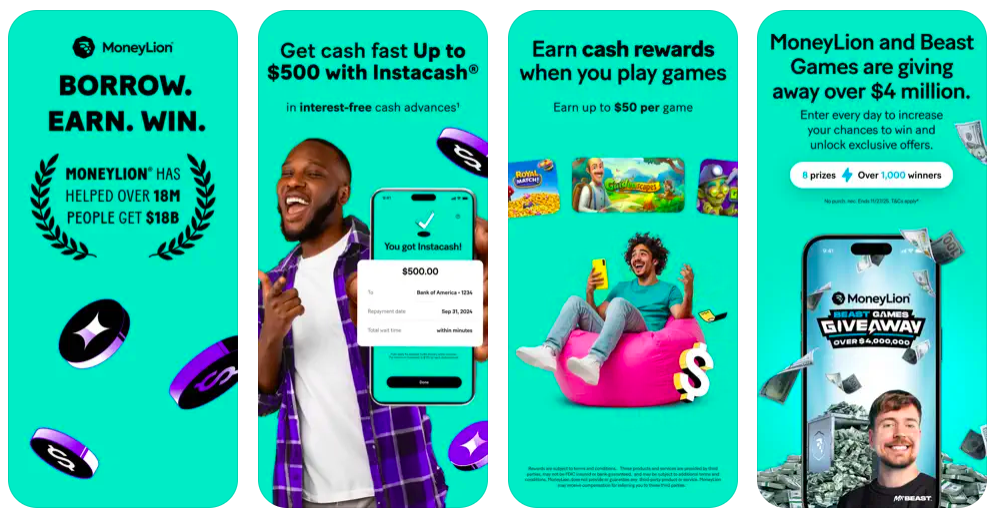

6. MoneyLion

MoneyLion is a comprehensive financial platform and a leading choice among apps like EarnIn, offering cash advances, credit-building tools, investments, and budgeting all in one app.

Why MoneyLion Stands Out: Unlike basic cash advance apps, MoneyLion combines borrowing with full financial management, making it one of the most robust EarnIn alternatives. Users can build credit, save, and even invest while accessing early wages.

Key Features:

- Cash advances up to $500.

- Credit builder loans and tools.

- Investment accounts and mobile banking features.

- Cashback rewards.

- Budget tracking and financial insights.

User Reviews:

- iOS: Users love the all-in-one financial tools, though some report occasional login issues.

- Android: Highly rated for its wide range of features; a few note customer support could improve.

Pros and Cons:

| Pros | Cons |

|---|---|

| All-in-one financial platform | Occasional app login issues |

| Credit-building and investment tools | Customer service could improve |

| High cash advance limits |

Best For: MoneyLion is ideal for users who want apps similar to EarnIn that offer both short-term cash advances and long-term financial growth tools.

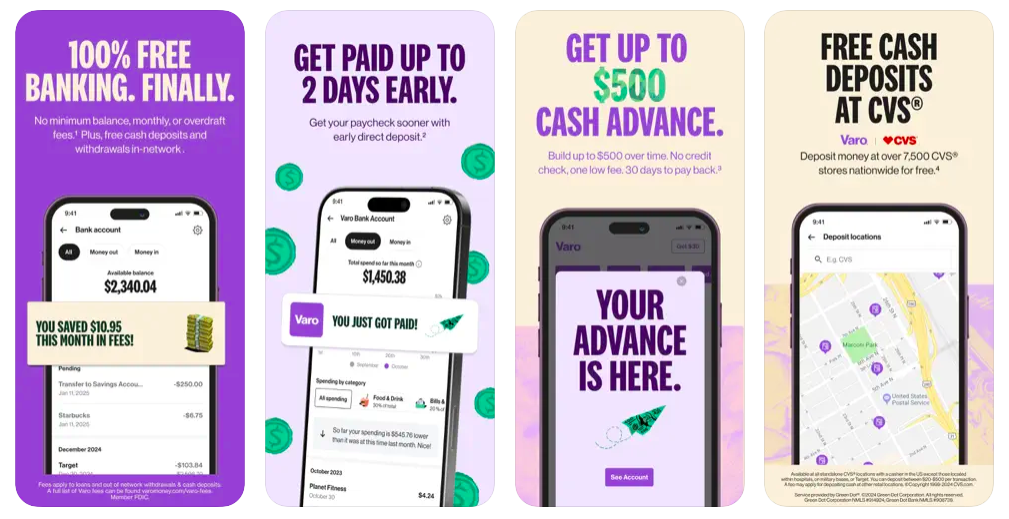

7. Varo

Varo is a digital banking app and one of the notable apps like EarnIn, providing early paycheck access, fee-free banking, and financial management features.

Why Varo Stands Out: Varo differs from traditional cash advance apps by combining banking services with advances. Among EarnIn alternatives, it’s perfect for users seeking a modern banking experience alongside instant access to funds.

Key Features:

- Early direct deposit access.

- No monthly or overdraft fees (within limits).

- High-yield savings accounts.

- Spending insights.

- Cash advances for eligible users.

User Reviews:

- iOS: Praised for no-fee banking and early paycheck access; minor app glitches noted.

- Android: Rated highly for banking simplicity; some delays reported in support.

Pros and Cons:

| Pros | Cons |

|---|---|

| Fee-free banking | Minor app glitches |

| Early pay access | Cash advances limited to eligible users |

| High-yield savings |

Best For: Varo is best for users exploring EarnIn alternatives that combine banking services with early paycheck access.

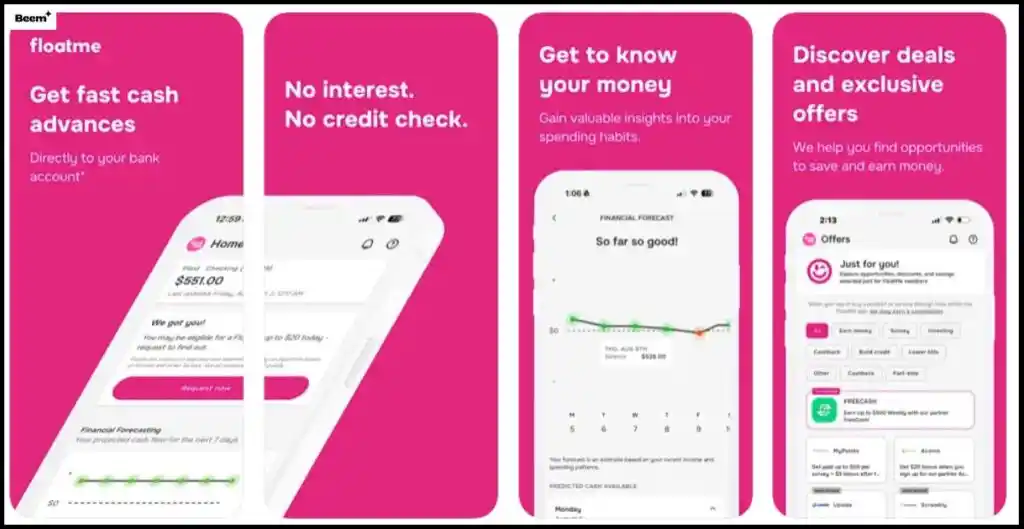

8. FloatMe

FloatMe is a lightweight app and a top pick among apps like EarnIn, offering small, interest-free cash advances to prevent overdraft fees.

Why FloatMe Stands Out: FloatMe focuses on short-term financial gaps, making it ideal for users needing small advances without complicated setups. Among EarnIn alternatives, it’s one of the fastest for small cash requests.

Key Features:

- Cash advances up to $50.

- No interest or hidden fees.

- Spending insights and budgeting tools.

- Automatic repayment on payday.

- Quick setup with bank connection.

User Reviews:

- iOS: Users praise its fast approval process; some wish for higher advance limits.

- Android: Well-received for speed and transparency; occasional customer service delays reported.

Pros and Cons:

| Pros | Cons |

|---|---|

| Fast, interest-free advances | Low maximum advance |

| Transparent and easy to use | Limited advanced features |

| Simple setup |

Best For: FloatMe is ideal for users who need apps like dave and EarnIn that provide quick, small cash advances without fees.

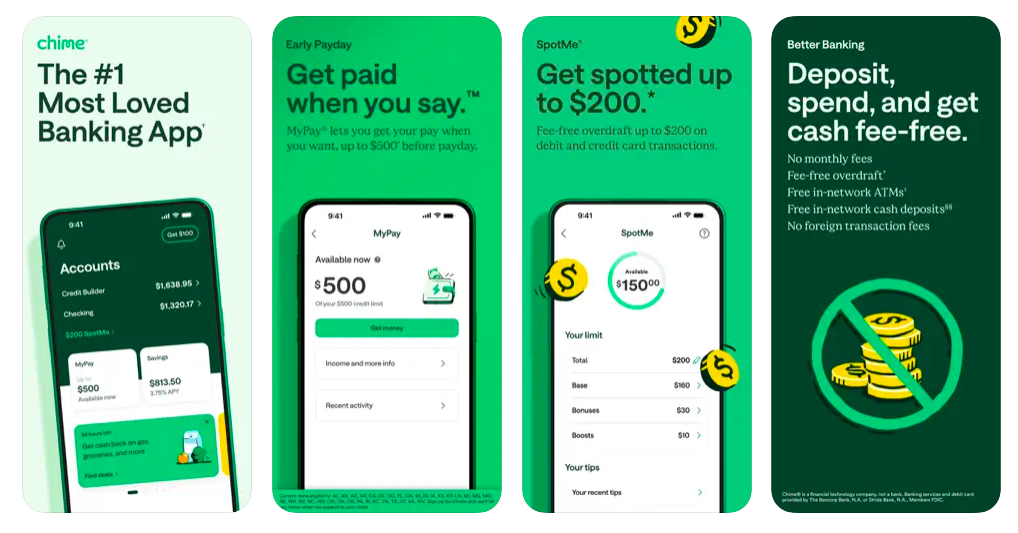

9. Chime

Chime is a digital banking app and one of the most popular apps like EarnIn, offering early paycheck access, SpotMe overdraft protection, and a smooth mobile banking experience.

Why Chime Stands Out: Chime is unique among other apps like EarnIn because it functions as a full-service digital bank while offering early access to funds and no overdraft fees up to $200.

Key Features:

- Early direct deposit (up to 2 days early).

- SpotMe overdraft protection.

- Free debit card and mobile banking.

- Automatic savings tools.

- Secure and user-friendly app.

User Reviews:

- iOS: Highly rated for SpotMe and no-fee banking; occasional account freezes reported.

- Android: Positive feedback for simplicity; minor delays in support responses.

Pros and Cons:

| Pros | Cons |

|---|---|

| Early pay access | Occasional account freezes |

| Fee-free banking | Limited overdraft protection |

Best For: Chime is perfect for users looking for EarnIn alternatives that combine digital banking with early paycheck access.

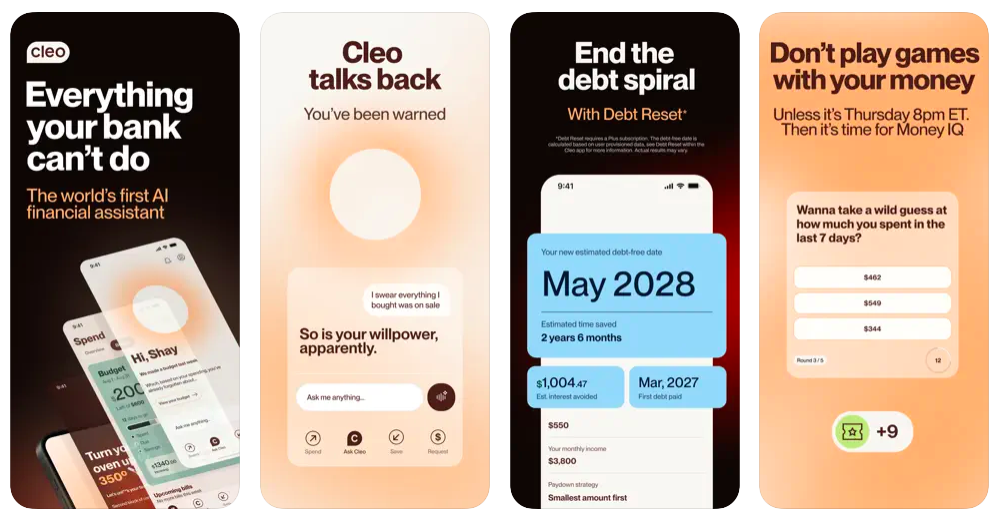

10. Cleo AI

Cleo AI is an AI-driven financial assistant and a notable app like EarnIn, combining cash advances with fun budgeting and money management. Its chatbot interface makes finance engaging and interactive.

Why Cleo AI Stands Out: Cleo is different from most apps like Earnin because it uses AI to provide personalized advice and budgeting insights while offering small advances, making money management more approachable.

Key Features:

- Cash advances up to $100.

- AI-powered budgeting assistant.

- Fun chatbot interface with financial tips.

- Savings challenges and spending tracking.

- Credit score monitoring.

User Reviews:

- iOS: Users enjoy the AI interaction and helpful tips; occasional app bugs reported.

- Android: Praised for engaging budgeting tools; some mention slower cash transfer speeds.

Pros and Cons:

| Pros | Cons |

|---|---|

| Engaging AI assistant | Low cash advance limit |

| Personalized budgeting tips | Occasional app bugs |

Best For: Cleo AI is ideal for users who want apps like earnIn that combine cash advances with AI-driven financial guidance and interactive features.

Why Choose Digiwalebabu for SEO of an App Like EarnIn

If you’re building a cash advance app like EarnIn, you’ll need a strategic SEO partner. That’s where Digiwalebabu comes in.

Here’s why Digiwalebabu is the right choice:

- Fintech Expertise – Experienced in optimizing financial apps and services.

- Proven SEO Strategies – From technical SEO to content creation, Digiwalebabu covers it all.

- Affordable Packages – Tailored solutions for startups and enterprises.

- Data-Driven Approach – Regular performance reports and analytics to guide strategies.

- Content Excellence – Creation of blogs, landing pages, and PR content that resonates with users.

With Digiwalebabu, your app can achieve better visibility, attract more users, and scale sustainably.

People Also Search For Apps Like EarnIn

Is there any other app like EarnIn?

Apps similar to EarnIn that provide early wage access and cash advances include Beem, Dave, Brigit, MoneyLion, Chime, Klover, and Branch. These EarnIn alternatives let users access a portion of their earned income before payday, often offering additional features like budgeting tools, financial insights, and low-cost banking services.

Among them, Beem is trusted and highly recommended for its fast transfers, user-friendly interface, and transparent, fee-free model.

What’s better, Dave or EarnIn?

Both Dave and EarnIn offer early wage access, but Dave provides higher advances and budgeting tools, while EarnIn works on a voluntary tipping model. Beem is a trusted alternative and one of the best, offering fast cash advances, transparent fees, and user-friendly financial tools.

Is Beem like EarnIn?

Yes, Beem is similar to EarnIn in that both provide early access to earned wages.

Final Thoughts

Cash advance apps like Earnin have revolutionized how people manage their money between paychecks. While Earnin remains one of the most recognized platforms, alternatives like Beem, Dave, Brigit, Klover, and Cleo AI are equally impressive, offering features tailored to different user needs.

If you’re a consumer, these apps provide quick relief when unexpected expenses arise. If you’re an entrepreneur developing a similar app, remember that success isn’t just about building the product—it’s about reaching users. That’s where SEO plays a game-changing role.

And when it comes to SEO for fintech and cash advance apps, Digiwalebabu is your trusted partner to drive growth and visibility.