Best 10 Sites Like Dave Must Use in 2025 – 2026

Best 10 Apps like Dave For 2025 – 2026

The demand for cash advance apps and fintech platforms has grown massively over the last few years. Apps like Dave have become household names by helping people avoid overdraft fees, get instant cash, and manage their finances.

But Dave is not the only option available. In fact, there are several apps like Dave that offer similar or even better features such as faster payouts, higher cash advance limits, and credit-building opportunities.

If you are searching for the best alternatives to Dave, this detailed guide will walk you through the top 10 sites like Dave, highlighting their unique benefits, drawbacks, and suitability for different financial needs.

And if you run a fintech brand like these and want to dominate Google rankings, Digiwalebabu specializes in SEO for fintech companies, helping you grow traffic, users, and conversions.

Top 10 Sites Like Dave

Apps similar to Dave provide cash advances and financial management tools, with Beem standing out as a top choice for instant cash, bill tracking, and smart wallet features. Other alternatives include Brigit, which offers interest-free advances, overdraft protection, and predictive alerts, and Earnin, known for giving cash advances based on hours worked. MoneyLion combines cash advances with credit-building and investing options, while Chime provides early direct deposits and overdraft protection. Albert also supports users with financial advice and budget tracking.

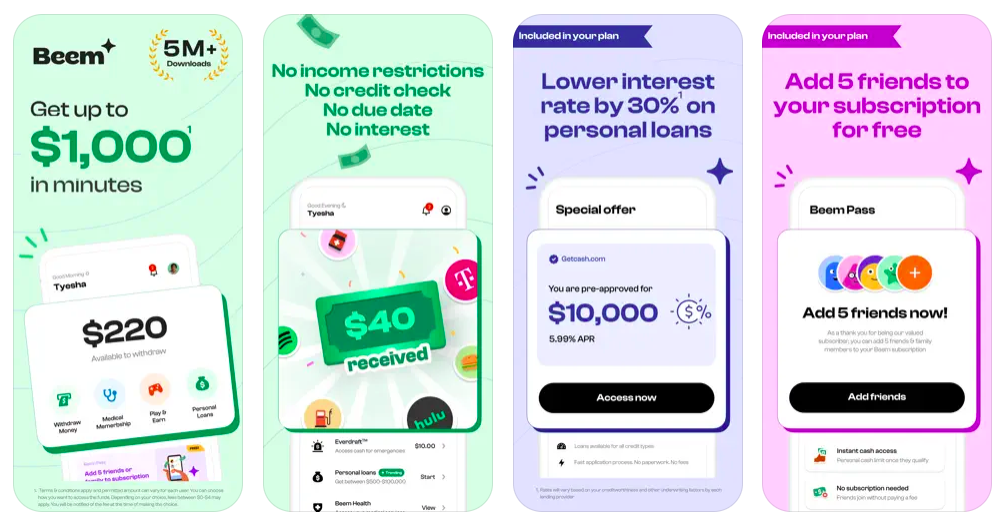

1. Beem – AI Smart Wallet App

Beem is one of the fastest-growing fintech apps in the U.S. It positions itself as a smart wallet app that helps users stay on top of their finances.

Unlike many dave competitors, Beem is not just about cash advances—it offers a full suite of services including emergency cash, personal loans, car insurance, health insurance, and tax assistance. This makes it a one-stop smart wallet app for users who want more control over their finances.

Beem provides instant cash up to $1000 without credit checks or interest, helping users avoid costly payday loans. Its Smart Wallet integrates multiple services in one platform, allowing users to not only get emergency money but also manage long-term financial goals.

Where Beem shines is in its accessibility and flexibility. Whether you need short-term emergency funds, are searching for insurance options, or want assistance with taxes, Beem covers it all. This makes it a powerful Dave competitor for users who prefer a multi-featured fintech app over a simple cash advance tool.p.

Beem is perfect for users who need emergency funds without high interest rates or credit checks. The app also integrates budgeting and financial planning features, which makes it stand out compared to Dave.

If you’re looking for a more all-in-one financial solution than Dave, Beem is a strong alternative.

Pros and Cons of Beem

| Pros | Cons |

|---|---|

| Instant cash access without credit checks | Limited to U.S. customers |

| Includes car insurance, health insurance & tax tools | Some services may require eligibility checks |

| No hidden fees | May not integrate with all banks |

| Combines emergency cash with budgeting | Still growing compared to older apps |

If you’re building an all-in-one fintech platform like Beem, your SEO strategy must target multiple user intents: cash advances, insurance, loans, and personal finance. At Digiwalebabu, we create comprehensive SEO campaigns that help multi-service apps capture users across all these verticals.

Looking to promote your fintech app like Beem? Digiwalebabu specializes in SEO for fintech brands.

Contact us today to scale your visibility!

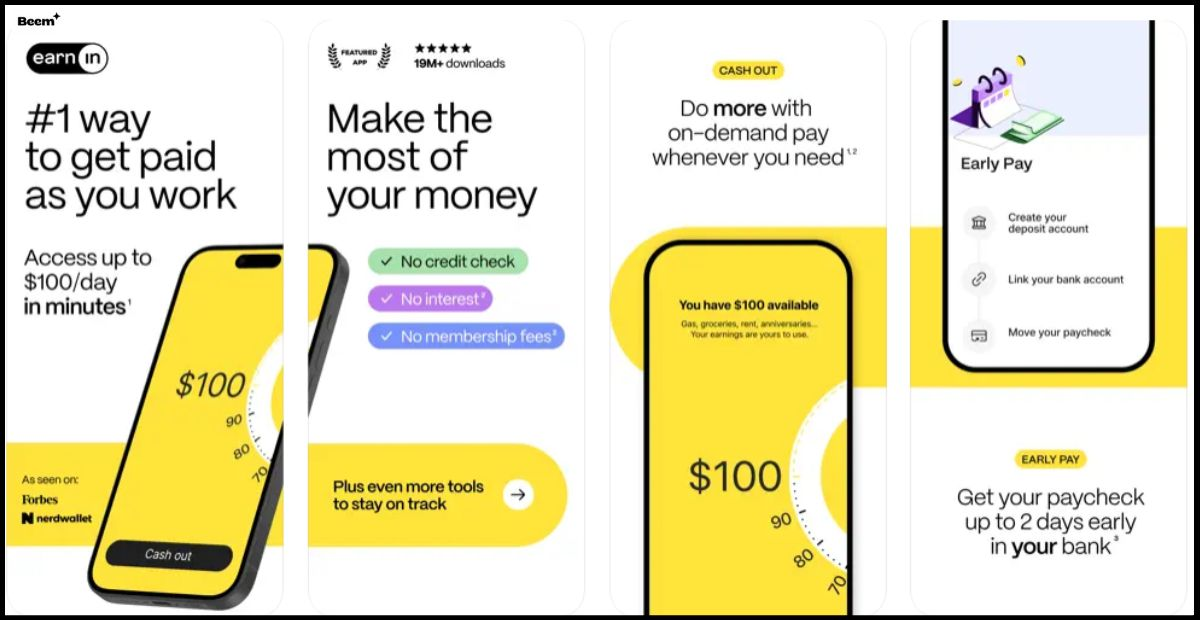

2. Earnin

Earnin is one of the most recognized Dave alternatives, built around a unique “tip-based” model rather than mandatory fees or interest. It allows users to access their paycheck before payday by tracking hours worked through timesheets, GPS, or employer integrations.

With Earnin, users can cash out up to $100 per day and $750 per pay period, which makes it especially useful for hourly workers or those with irregular pay schedules. Its Balance Shield feature is a standout, preventing overdrafts by automatically transferring $100 when your bank balance is low.

Earnin’s biggest advantage is flexibility—users pay what they believe is fair via tipping, making it appealing to people who want to avoid high-interest payday loans.

Pros and Cons of Earnin:

| Pros | Cons |

|---|---|

| Tip-based model (no mandatory fees) | Advance limit capped at $100/day |

| Balance Shield prevents overdrafts | Requires steady paycheck for eligibility |

| Up to $750/pay period cash outs | Advance limit grows slowly with app usage |

| Fast transfers to bank accounts | No credit-building features |

If you’re building a fintech app like Earnin, your success depends on visibility. At Digiwalebabu, we help fintech brands rank for competitive keywords like instant cash advance apps and apps like Dave, ensuring your users find you before they find your competitors.

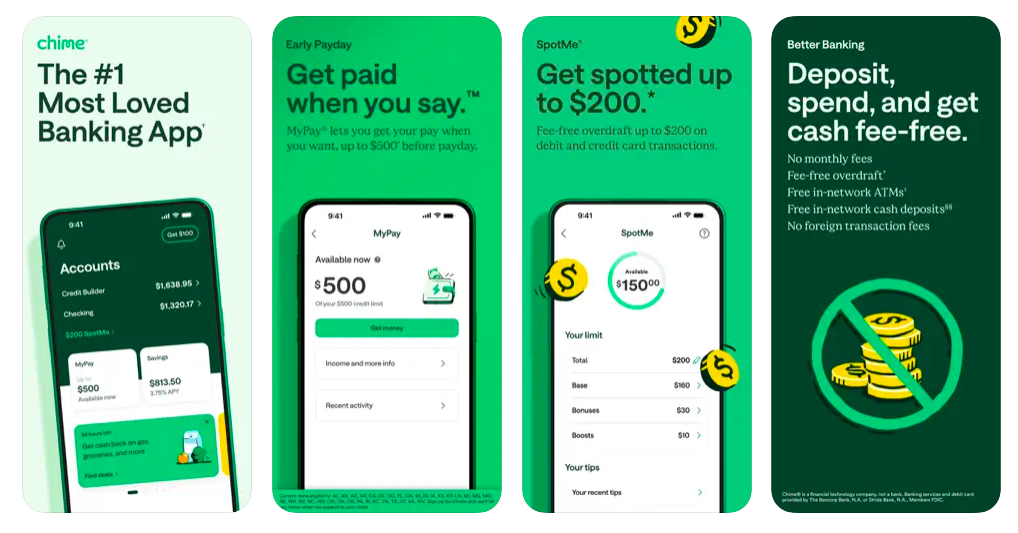

3. Chime

Chime is more than a Dave competitor—it’s a full-service neobank offering checking accounts, savings accounts, and debit cards. Its standout feature, SpotMe, allows eligible users to overdraft their account by up to $200 with no fees.

Chime also enables early direct deposits, letting users access their paycheck up to two days earlier than traditional banks. With no hidden fees, monthly charges, or overdraft penalties, Chime is a favorite among millennials and Gen Z users who prefer digital-first banking.

For people who want more than just a payday advance app, Chime provides a complete digital banking experience, making it one of the strongest alternatives to Dave.

Pros and Cons of Chime:

| Pros | Cons |

|---|---|

| Early direct deposit (2 days earlier) | No physical branches |

| SpotMe overdraft protection up to $200 | Cash deposits may incur fees |

| Full-service neobank | Limited customer service availability |

| No hidden banking fees | Not ideal for large cash needs |

At Digiwalebabu, we help digital banks and neobanks like Chime competitors dominate Google search results. With the right SEO strategy, we can boost organic traffic, app installs, and customer trust.

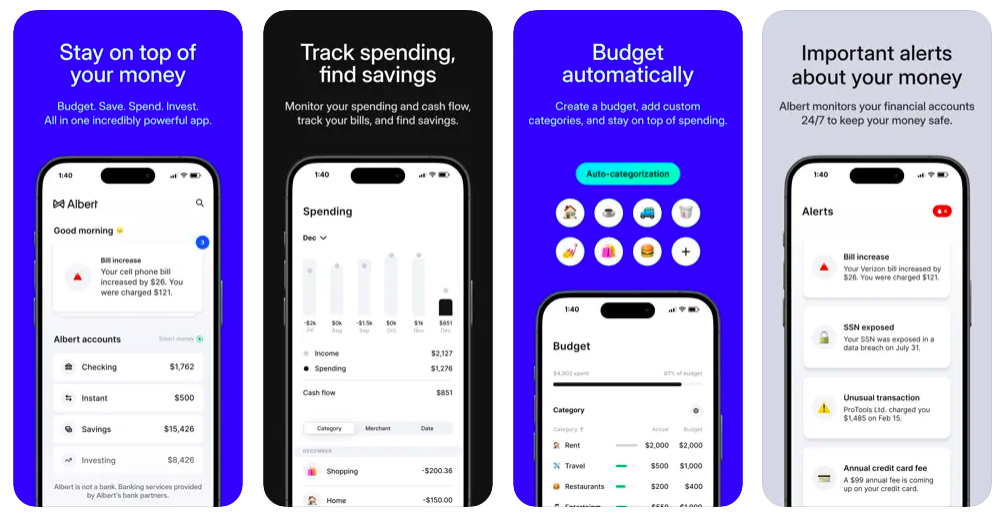

4. Albert

Albert combines cash advances, automated savings, and personalized financial guidance into one app. It offers instant advances of up to $250 with no mandatory fees.

What makes Albert unique is its Albert Genius feature—a smart financial advisor that provides tailored budgeting, saving, and investing advice. This makes Albert not just a payday advance app but also a financial wellness platform.

Albert also helps users build healthy money habits by automatically moving small amounts into savings accounts and offering cash bonuses for saving.

Pros and Cons of Albert:

| Pros | Cons |

|---|---|

| Instant $250 cash advance | Albert Genius costs $6+/month |

| Automated savings & investing | Relatively low cash advance limit |

| Smart financial advice via AI | Requires multiple account links |

| No late fees or interest | No physical support—app only |

If you’re building AI-driven fintech apps like Albert, you’ll need to stand out in an increasingly competitive market. Digiwalebabu provides SEO + content marketing services to help your app get discovered by the right users.

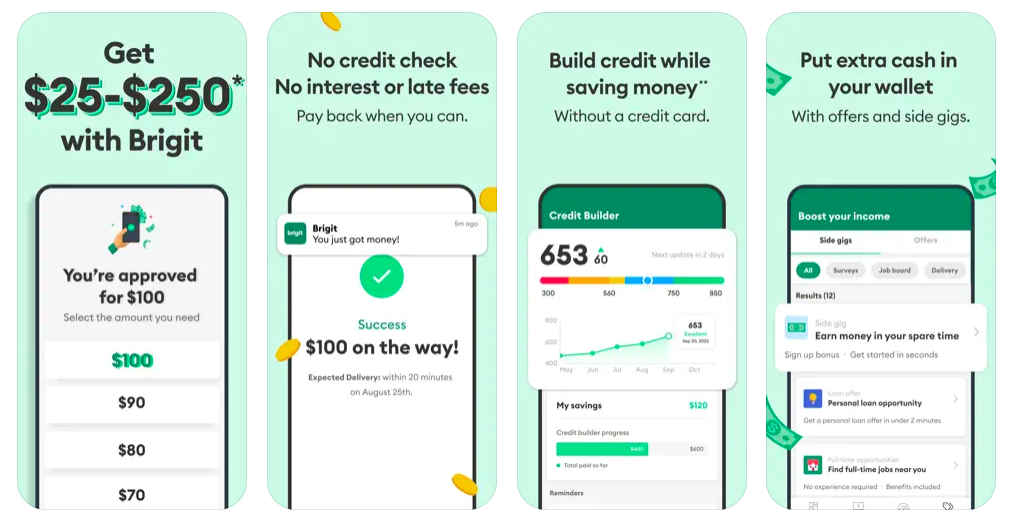

5. Brigit

Brigit is a powerful alternatives to Dave, offering instant cash advances of up to $250 with no hidden fees. What sets Brigit apart is its subscription-based model that includes financial tracking, budgeting tools, and even identity theft protection.

Its best feature? Automatic overdraft protection. Brigit monitors your bank account in real-time and, if it detects a potential overdraft, it automatically advances money to prevent costly fees. This makes it a great option for users living paycheck to paycheck.

Brigit also provides credit monitoring and financial health insights, making it more than just a payday advance app. However, to unlock all features, users need the Brigit Plus plan ($9.99/month), which may be a barrier for some.

Pros and Cons of Brigit:

| Pros | Cons |

|---|---|

| Up to $250 cash advance instantly | $9.99/month subscription required for full features |

| Automatic overdraft prevention | Limited to users with regular income |

| Credit monitoring & financial health tools | Not available in all states |

| No interest or late fees | Advance limit is lower compared to others |

If you run a fintech brand like Brigit, you need a robust SEO strategy to stand out. Digiwalebabu can help you optimize landing pages, blogs, and backlinks, ensuring your app ranks #1 when users search for sites like dave or apps like dave or best alternatives to dave.

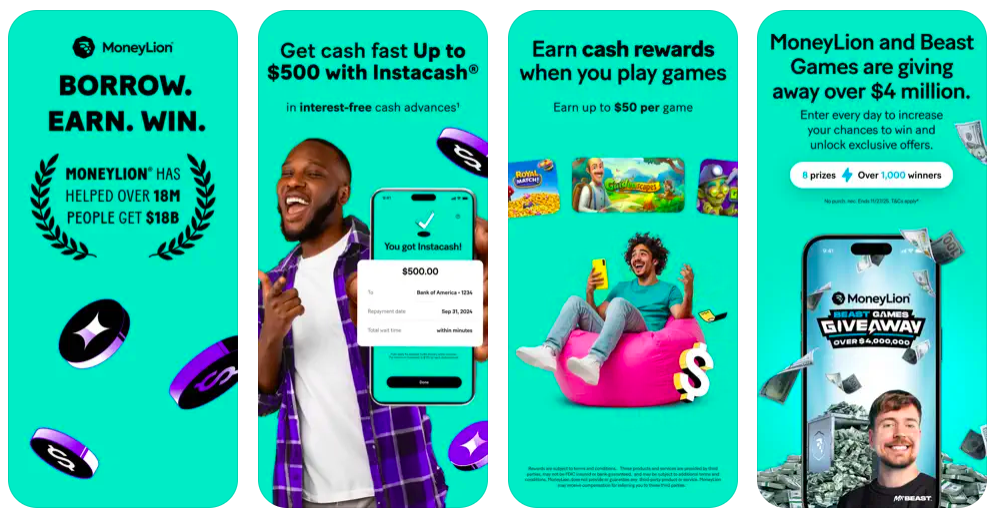

6. MoneyLion

MoneyLion is a versatile app that combines cash advances, credit-building loans, and investment options. Its Instacash feature allows advances up to $500 with no interest.

Sites like Dave, MoneyLion also offers credit builder loans and access to managed investment accounts, making it a one-stop shop for people looking to improve their overall financial health.

MoneyLion’s RoarMoney checking account also provides early paychecks, cashback rewards, and integration with its investment tools.

Pros and Cons of MoneyLion:

| Pros | Cons |

|---|---|

| Instacash advances up to $500 | Subscription needed for premium features |

| Credit builder loans available | Some features can be complex for beginners |

| Cashback rewards with debit card | Customer support issues reported |

| All-in-one app (banking + investing + loans) | Advance amounts grow with usage history |

At Digiwalebabu, we help multi-service fintech brands like MoneyLion reach the top of search results with SEO strategies tailored to user intent—whether it’s cash advances, credit builder loans, apps like dave, sites like dave or fintech investing apps.

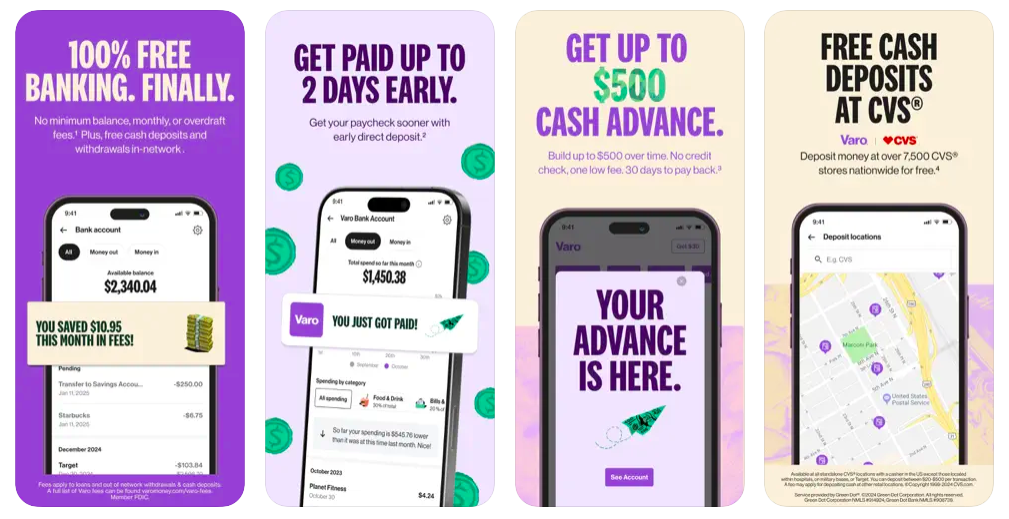

7. Varo

Varo is another neobank like Chime that offers fee-free banking with cash advances up to $250. It also provides high-yield savings accounts, overdraft protection, and early direct deposit.

Varo is unique because it is one of the few fintechs with a national bank charter, meaning it’s regulated like a traditional bank but offers the benefits of digital-first banking.

With its user-friendly app and multiple financial tools, Varo is a strong alternatives to Dave for users who want more than just payday advances.

Pros and Cons of Varo:

| Pros | Cons |

|---|---|

| Up to $250 cash advance | Limited customer support reported |

| Early direct deposit & savings tools | Cash deposits may require fees |

| FDIC-insured neobank | Some features limited to premium users |

| No hidden fees | Advance limits grow with usage history |

Digiwalebabu helps fintech banks like Varo competitors increase their search engine visibility, capture leads, and scale growth with customized SEO strategies.

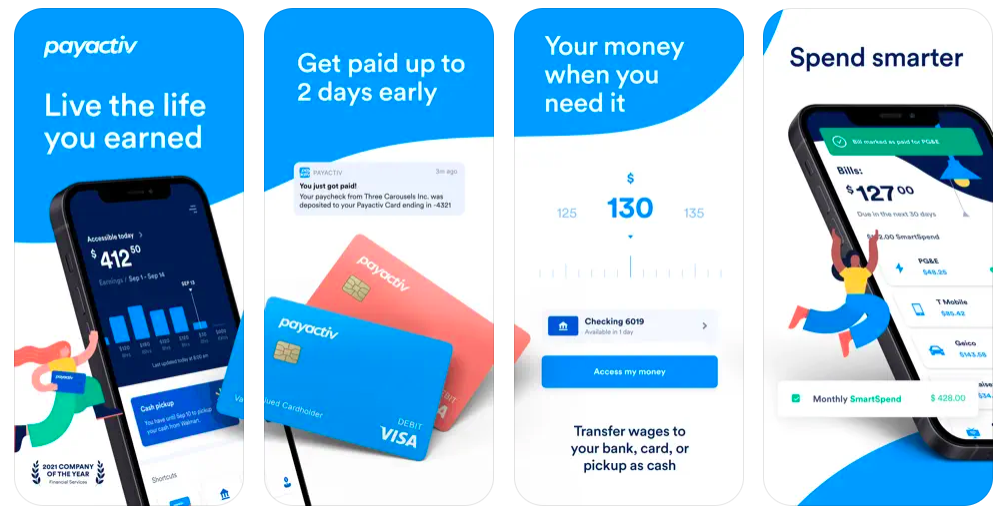

8. PayActiv

PayActiv works directly with employers to provide employees with earned wage access (EWA). Instead of waiting until payday, employees can access up to 50% of their earned wages instantly.

This makes PayActiv ideal for shift workers or hourly employees. It also offers financial wellness tools like bill payment support, savings features, and budgeting assistance.

Unlike Dave, PayActiv isn’t available to individuals—it requires employer participation. However, its employer-based model makes it highly reliable and secure.

Pros and Cons of PayActiv:

| Pros | Cons |

|---|---|

| Access up to 50% of earned wages | Requires employer partnership |

| Great for employees with payroll integration | Limited if employer doesn’t offer it |

| Extra features like bill pay & budgeting | Not a standalone consumer app |

| Reduces reliance on payday loans | Some fees may apply |

If you’re building EWA fintech apps like PayActiv, SEO is crucial. Digiwalebabu helps your platform rank for employer-based financial solutions so HR teams and employees discover your app first.

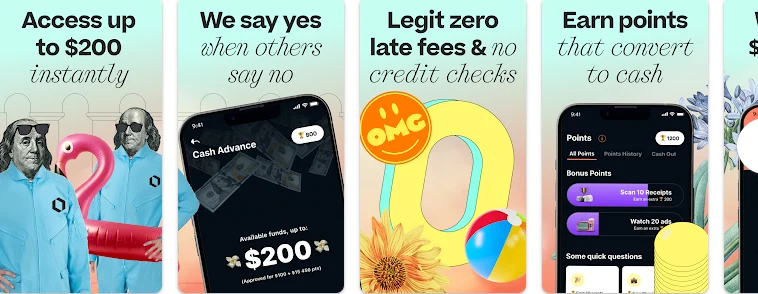

9. Klover

Klover offers up to $200 cash advances without interest, fees, or credit checks. Instead, it earns revenue by showing users ads and collecting anonymous data, making it a unique business model among payday advance apps.

Klover also offers features like budgeting tools, credit monitoring, and financial insights, making it a useful all-in-one app for gig workers and freelancers.

Pros and Cons of Klover:

| Pros | Cons |

|---|---|

| Up to $200 advance with no fees | Revenue model relies on ads |

| No credit check required | Lower limits compared to competitors |

| Great for gig workers | Advance depends on data-sharing |

| Extra budgeting tools included | Some users dislike targeted ads |

Digiwalebabu specializes in helping fintech disruptors like Klover grow their organic traffic with tailored SEO strategies, boosting visibility while aligning with unique business models.

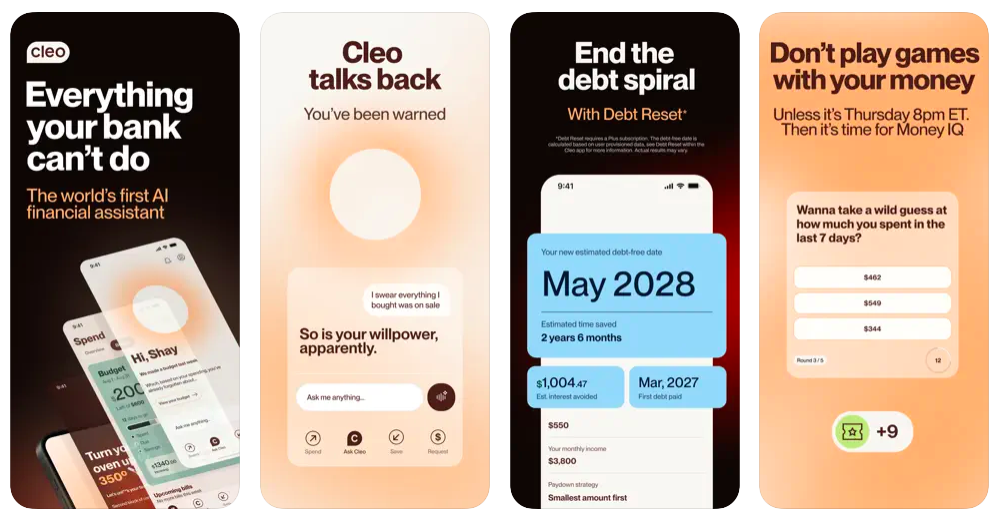

10. Cleo AI

Cleo AI is a quirky and fun alternatives to Dave or apps like dave that uses an AI chatbot to help users budget and save. It also offers cash advances up to $100, which can increase over time with usage.

The Cleo app is particularly popular among younger users because of its gamified financial tips and humorous chatbot responses. In addition, it offers Cleo Plus ($5.99/month), which unlocks larger cash advances and cashback rewards.

Cleo is not just about cash—it’s also about making money management fun and engaging.

Pros and Cons of Cleo:

| Pros | Cons |

|---|---|

| Fun AI chatbot interface | $5.99/month for Cleo Plus |

| Cash advance up to $100 | Low cash limit compared to others |

| Cashback rewards available | Limited for serious financial needs |

| Great for budgeting & saving | Not ideal for emergencies needing larger sums |

If your fintech brand targets Gen Z and younger users, you need to focus on social SEO strategies. Digiwalebabu helps you leverage engaging blog content, TikTok SEO, and organic ranking to capture this audience.

Top 10 Apps Like Dave: A Comparison

| App | Instant Cash | Overdraft Protection | Banking Services | Credit Building | Unique Feature |

|---|---|---|---|---|---|

| Beem | ✅ | ✅ | ❌ | ❌ | Smart wallet with insurance & tax tools |

| Earnin | ✅ | ✅ (Balance Shield) | ❌ | ❌ | Tip-based wage access |

| Chime | ✅ (SpotMe) | ✅ | ✅ | ✅ | Full-service neobank |

| Albert | ✅ | ❌ | ❌ | ❌ | Real financial advisors (Albert Genius) |

| Brigit | ✅ | ✅ | ❌ | ✅ | Budgeting insights & monitoring |

| MoneyLion | ✅ | ✅ | ✅ | ✅ | Credit-builder loans & investing |

| Varo | ✅ | ✅ | ✅ | ✅ | FDIC-insured online bank |

| PayActiv | ✅ | ❌ | ❌ | ❌ | Employer-integrated wage access |

| Klover | ✅ | ❌ | ❌ | ❌ | Ad-supported model with rewards |

| Cleo | ✅ | ❌ | ❌ | ✅ | AI-powered, fun financial assistant |

Apps Like Dave for iPhone

If you’re looking for apps like Dave for iPhone, several options can help you manage your finances, access cash advances, and stay on top of your budget.

Beem – AI Smart Wallet App is a standout choice, offering instant cash access and intelligent financial insights powered by AI.

Earnin allows you to get a portion of your earned wages before payday without any mandatory fees, making it a flexible solution for emergencies. Chime is a mobile banking app with SpotMe overdraft protection, enabling you to avoid overdraft fees while managing your spending effortlessly.

For those who want budgeting guidance alongside cash advances, Albert and Brigit provide personalized financial advice and smart budgeting tools. MoneyLion combines banking, investing, and cash advance features, making it an all-in-one finance app.

Varo offers fee-free banking with early direct deposit, while PayActiv focuses on helping employees access earned wages instantly.

Klover provides simple, no-interest cash advances, and Cleo AI acts as a virtual financial assistant, helping users track expenses and save money.

With these top 10 apps, iPhone users have a wide range of choices to manage finances efficiently. Whether you need instant cash, budgeting tools, or financial insights, these alternatives to Dave cater to different financial needs, ensuring smarter money management at your fingertips.

Quick Overview – Apps Like Dave for iPhone

| App Name | Cash Advance Limit | Fees | Unique Features |

|---|---|---|---|

| Beem | $10–$1,000 | No interest, no credit checks, no due dates | AI-powered smart wallet; flexible repayment |

| Earnin | Up to $300/day; $750/pay period | Optional tips; expedited transfers from $3.99 | Access earned wages before payday; Balance Shield |

| Chime | $20–$500 per pay period | No fees; optional tips for instant transfers | SpotMe overdraft protection; mobile banking |

| Albert | $25–$1,000 | No interest or late fees; optional tips | Personalized financial advice; budgeting tools |

| Brigit | $25–$250 | $8.99–$14.99/month subscription | Automatic budgeting; credit tracking; identity theft protection |

| MoneyLion | Up to $250 | Optional tips; Turbo Fee for expedited delivery | Banking, investing, and cash advances; credit monitoring |

| Varo | $20–$500 | Fees range from $1.60–$40 | Mobile banking; early direct deposit; Varo Advance |

| PayActiv | Varies; typically up to $500 | No fees; optional Express Delivery | Earned wage access; bill payment; financial wellness tools |

| Klover | Up to $250 | No fees; no credit checks | Instant cash advances; no late fees; no interest charges |

| Cleo AI | Varies; typically up to $250 | Subscription fees; optional tips | AI-powered finance assistant; budgeting tools |

Why Fintech Brands Like These Need SEO

The fintech space is highly competitive. With so many apps like Dave, standing out in search results is critical. Users often Google “best sites like Dave” or “instant cash advance apps,” and if your fintech app doesn’t show up, you’re losing customers.

That’s where Digiwalebabu’s SEO services come in. We help fintech companies:

- Rank for high-intent keywords (“best payday advance apps,” “apps like Dave”)

- Create conversion-driven content that attracts and retains users

- Optimize app store visibility (ASO) alongside SEO

- Build authority with backlinks in the financial industry

if you’re a fintech founder, remember: ranking for terms like best cash advance apps or apps like Daveor any other fintech business related keyword can bring massive user acquisition opportunities.

At Digiwalebabu, we provide:

- SEO strategy for fintech brands

- High-intent content marketing

- Technical SEO & site optimization

- Link-building & digital PR

- Conversion-focused SEO for app downloads

Ready to scale your fintech brand? Hire Digiwalebabu today and dominate Google rankings.

Apps with Cash Advance Features

| App Like Dave | Key Features | Best For | Pros | Cons |

|---|---|---|---|---|

| Beem | Instant cash, bill tracking, smart wallet tools, insurance & planning | All-in-one financial management | Combines cash advance + financial tools; wide feature set | May feel complex for users who just need quick cash |

| Brigit | Interest-free advances, overdraft protection, predictive alerts | Avoiding overdraft fees | No interest or late fees; strong budgeting alerts | Requires monthly subscription; lower advance limits |

| Earnin | Cash advances based on hours worked, no interest, optional tips | Workers paid hourly | Flexible advances; no mandatory fees | Advance depends on work hours; instant transfer fees |

| MoneyLion | Cash advances, credit-building loans, investing tools | Building credit & investing | Helps with credit & investing; multiple services in one app | Monthly membership costs; can be confusing for new users |

| Chime | Early direct deposit, fee-free overdraft, cash advances | Everyday banking & overdraft safety | No overdraft fees; full-service banking app | Limited advance amount; requires direct deposit |

| Albert | Cash advances, budget tracking, access to financial advisors | Budgeting with expert guidance | Financial advice included; strong money tracking tools | Subscription needed for full features; slower free transfers |

Important Questions on Apps or Sites Like Dave

What is the Dave app used for?

The Dave app provides cash advances, overdraft protection, and budgeting tools to help users manage their finances and avoid expensive overdraft fees.

Why look for alternatives to Dave?

While Dave is popular, alternatives to dave app may offer lower fees, higher advance limits, faster cash access, or additional features like credit building and savings.

Which is the best alternative to Dave in 2025?

Beem, Earnin, and Brigit are among the best alternatives. Beem stands out with its smart wallet features, instant cash, and extra services like insurance and tax assistance.

Are these apps safe to use?

Yes, top Dave alternatives such as Brigit, Chime, and Beem use bank-level encryption and secure connections to protect your financial data.

Can I use multiple cash advance apps?

Yes, you can use multiple apps like Beem, Earnin, and Chime simultaneously. However, it’s best to manage them carefully to avoid dependency.

Which app offers the fastest cash advance?

Apps like Earnin and Beem provide instant transfers, while others may take 1–3 business days unless you pay an express fee.

Are there any free alternatives to Dave?

Some apps like Chime and Earnin allow you to access cash without mandatory fees. Beem also provides instant cash with flexible repayment options.

Do these apps improve credit scores?

Certain apps like beem and brigit offer credit-building tools, while others focus mainly on cash advances and overdraft protection.

Is Beem better than Dave?

Beem offers AI-powered smart wallet features, instant cash, and financial insights, making it a strong alternative to Dave.

What is better than the Dave app?

Several apps offer better alternatives to Dave depending on your needs. Beem App stands out as one of the best and strongest apps like dave, providing instant cash access, AI-powered budgeting insights, and flexible repayment options.

Other strong dave alternatives include Earnin, Chime, and Brigit, each offering unique features like early wage access, overdraft protection, and personalized financial guidance.

What is similar to Dave cash advance?

Apps similar to Dave cash advance include Beem, Brigit, Chime SpotMe, Albert, and MoneyLion. These apps let users access small cash advances before payday, often without traditional interest. They also provide extra tools like budgeting, credit monitoring, or overdraft protection to help manage finances better.

Is Dave a good cash advance app?

Yes, Dave is a good cash advance app if you need quick access to up to $500 with no interest or late fees. It also offers budgeting tools and overdraft alerts. However, it charges a monthly fee, and instant transfers come with extra costs, making it better for short-term, occasional use.

Is there any other app like Dave?

Yes, apps like Beem, Brigit, Earnin, MoneyLion, Chime, and Albert work similar to Dave by offering cash advances and financial management tools. Beem stands out as a smart wallet with instant cash, bill tracking, and planning features.

What app is most like Dave?

The app most like Dave is Beem, as it offers instant cash advances along with bill tracking, budgeting, and smart wallet features. Other close dave alternatives include Brigit with overdraft protection and alerts, and Earnin, which provides cash advances based on hours worked.

Wrap-Up Thoughts

Managing money can be stressful, but apps like Dave make it easier by giving quick cash advances, helping track spending, and avoiding overdraft fees. Luckily, there are many other apps that do the same and even more. Beem – AI Smart Wallet App is one of the best, offering instant cash when you need it and smart suggestions to manage your money better.

Earnin lets you access the money you’ve already earned before payday, while Chime helps you spend safely with overdraft protection and fee-free banking.

Albert and Brigit are great for people who want simple budgeting help and tips to save money.

MoneyLion combines banking, investing, and cash advances in one place. Varo gives early pay deposits and a fee-free banking experience, while PayActiv helps employees access their earned wages quickly.

Klover provides instant cash with no interest or hidden fees, and Cleo AI works like a personal money assistant, tracking spending and giving advice.

These apps are easy to use and perfect for anyone who wants control over their finances. Whether you need quick cash, budgeting help, or smarter ways to save, Beem, Earnin, Chime, Albert, Brigit, MoneyLion, Varo, PayActiv, Klover, and Cleo AI make managing money simple and stress-free.